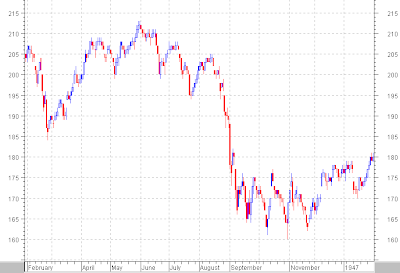

September is historically the worst month for the stock market. The stock market internals continue to weaken and I am keeping my crash helmet on for now. A few fractals in terms of September fireworks follow for those with a current bearish inclination towards equities like myself. First up, 2008 in the S&P 500 ($SPX):

Next up, 2001 in the S&P 500:

Or, an example from way back in 1946 (copied from chartsrus, a great site):

I think ol' Uncle Buck has a fall surprise in store for U.S. Dollar bears (again) and I think this will cause almost all asset classes to fall in a brief deflationary type drop. I am ready with cash, hoping to pick up some Gold miners on sale. My target level remains 40 for the GDX ETF and I expect to get there in the next 1-2 months. I think a disorderly move down in stocks is coming when "Wall Streeters" get back to their desks after Labor Day.